Indian crypto exchange WazirX has revealed the date for a creditor revote that, if passed, could pave the way for the long-awaited fund distribution.

WazirX Has Revealed The Creditor Revote Timeline

In a post on X, WazirX has shared an update on the situation regarding user crypto distribution. The exchange fell prey to an infamous hack one year ago, in which attackers linked with the North Korean Lazarus Group made away with almost $235 million in digital asset funds.

The platform closed its deposits and withdrawals in response to the attack, and to this day, it hasn’t been able to resume operations. This means that the rest of the original $500 million in user funds, around $265 million, are still stuck in limbo.

Recent developments, however, have finally set things in motion. In June, WazirX’s parent company, Zettai PTE LTD, a Singapore-based entity that was responsible for handling user crypto, went to the Singapore High Court with a distribution proposal that had overwhelming support from the creditors behind it.

This plan, however, had ended up finding rejection. Earlier this month, the company again went to court with a revised proposal, and this time, the court ended up giving it a green light. Alongside the announcement of the court hearing decision, WazirX had said another creditor vote will need to happen before the proposal can move forward.

Now, the exchange has formally announced a date for it: July 30th. This revote will remain live until August 6th. “If the requisite majority of creditors vote FOR the Scheme once again, the token distribution will start within 10 business days after the Scheme is effective, just as planned,” noted WazirX in the post.

This means that for the first time in this saga, users finally have a potential timeline for distribution. Alongside the distribution process, the exchange also plans to restart operations.

Nischal Shetty, CEO of WazirX, has also talked about the process in an X post. “A restart will also help us work towards generating profits and distributing it back to all creditors,” said Shetty.

The court had previously rejected the plan due to concerns about compliance with Singapore’s Financial Services and Markets Act (FSMA) and the involvement of Panama-based Zensui in the distribution process. The greenlight came as Zanmai Labs, the Indian company behind the exchange, was instead tasked with handling the funds.

It now remains to be seen whether creditors will vote in favor of the amended proposal, as they did for the last one, and potentially allow for an end to the long saga.

Bitcoin Has Seen A Sharp Profit-Taking Spree Recently

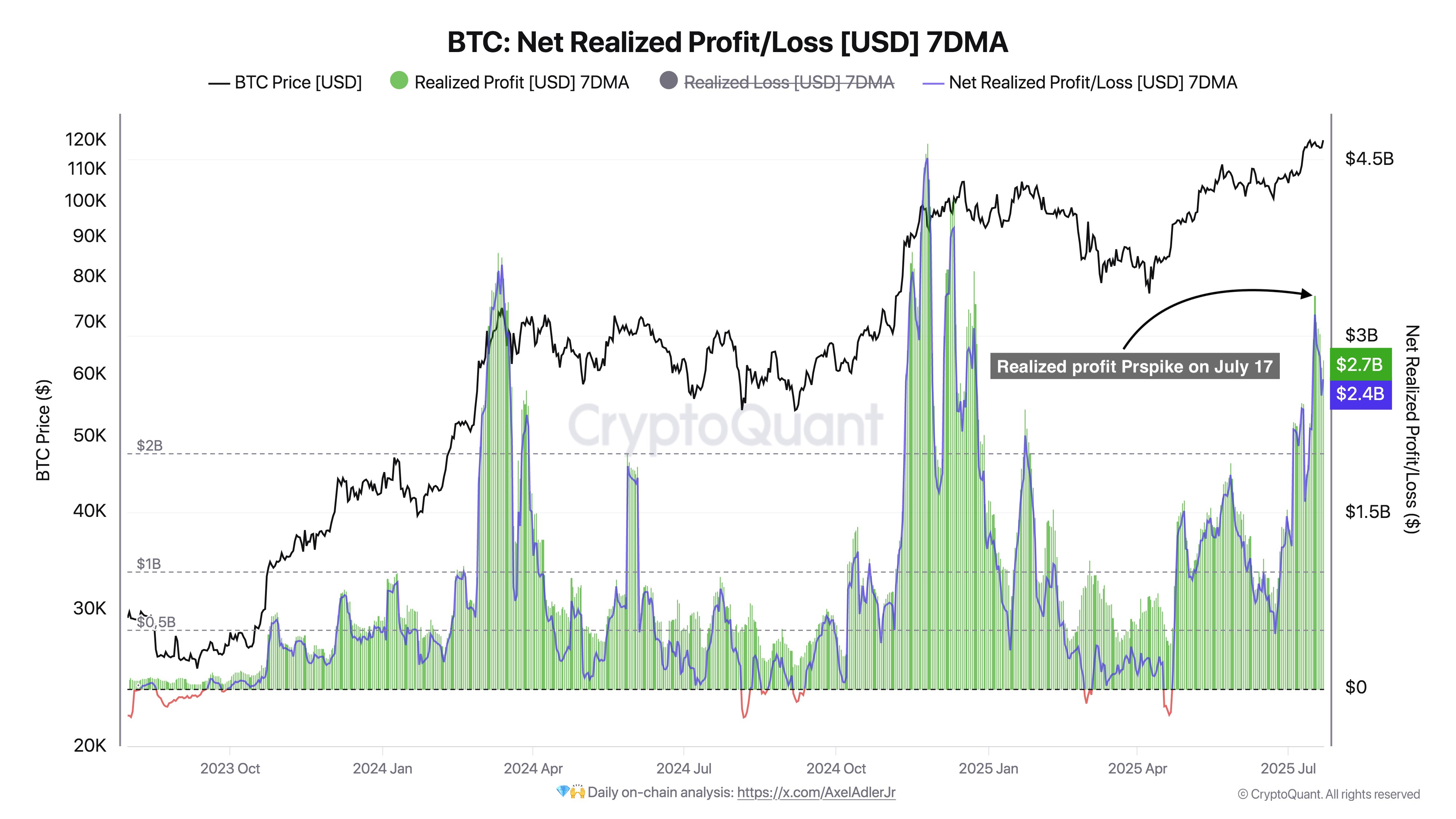

Bitcoin investors have participated in peak profit realization amounting to a whopping $3.3 billion recently, as CryptoQuant author Darkfrost has pointed out in an X post.

Since this selloff, Bitcoin has been locked in sideways movement, with its price still floating around the $118,300 mark today.

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Indian crypto exchange WazirX has revealed the date for a creditor revote that, if passed, could pave the way for the long-awaited fund distribution.

WazirX Has Revealed The Creditor Revote Timeline

In a post on X, WazirX has shared an update on the situation regarding user crypto distribution. The exchange fell prey to an infamous hack one year ago, in which attackers linked with the North Korean Lazarus Group made away with almost $235 million in digital asset funds.

Related Reading: Binance Pulls Ahead In Altcoin Boom, Takes Lion’s Share Of Volume

The platform closed its deposits and withdrawals in response to the attack, and to this day, it hasn’t been able to resume operations. This means that the rest of the original $500 million in user funds, around $265 million, are still stuck in limbo.

Recent developments, however, have finally set things in motion. In June, WazirX’s parent company, Zettai PTE LTD, a Singapore-based entity that was responsible for handling user crypto, went to the Singapore High Court with a distribution proposal that had overwhelming support from the creditors behind it.

This plan, however, had ended up finding rejection. Earlier this month, the company again went to court with a revised proposal, and this time, the court ended up giving it a green light. Alongside the announcement of the court hearing decision, WazirX had said another creditor vote will need to happen before the proposal can move forward.

Now, the exchange has formally announced a date for it: July 30th. This revote will remain live until August 6th. “If the requisite majority of creditors vote FOR the Scheme once again, the token distribution will start within 10 business days after the Scheme is effective, just as planned,” noted WazirX in the post.

This means that for the first time in this saga, users finally have a potential timeline for distribution. Alongside the distribution process, the exchange also plans to restart operations.

Nischal Shetty, CEO of WazirX, has also talked about the process in an X post. “A restart will also help us work towards generating profits and distributing it back to all creditors,” said Shetty.

The court had previously rejected the plan due to concerns about compliance with Singapore’s Financial Services and Markets Act (FSMA) and the involvement of Panama-based Zensui in the distribution process. The greenlight came as Zanmai Labs, the Indian company behind the exchange, was instead tasked with handling the funds.

Related Reading: Ethereum Whale Activity Explodes: Large-Transfer Volume Breaks $100 Billion

It now remains to be seen whether creditors will vote in favor of the amended proposal, as they did for the last one, and potentially allow for an end to the long saga.

Bitcoin Has Seen A Sharp Profit-Taking Spree Recently

Bitcoin investors have participated in peak profit realization amounting to a whopping $3.3 billion recently, as CryptoQuant author Darkfrost has pointed out in an X post.

The trend in the 7-day MA of the Bitcoin Realized Profit | Source: @Darkfost_Coc on X

Since this selloff, Bitcoin has been locked in sideways movement, with its price still floating around the $118,300 mark today.

Looks like the price of the coin has been unable to find a direction | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin