Despite several drawbacks in Bitcoin price lately, the flagship asset appears to be gaining bullish momentum and holding above the $90,000 mark. Looking at the current market structure, BTC is hinting at one of its rarest setups that could reshape and determine the next potential direction.

Uncommon Bitcoin Market Structure In Sight

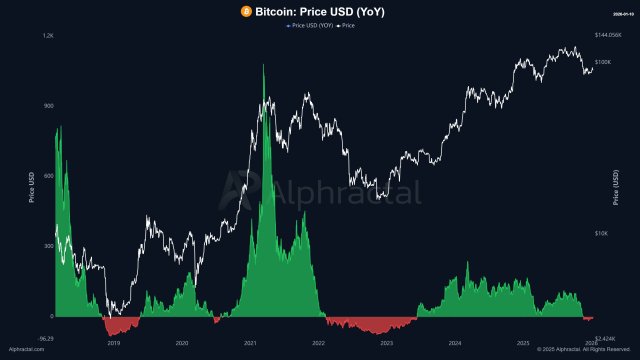

As seen in the cryptocurrency space, every market cycle has its own peculiarities, but Bitcoin is about to experience one of its most peculiar times yet. Alphractal, an advanced investment and data analytics platform, shared this development, which could reshape the current BTC trend.

Although no single indication can predict a result, the current configuration indicates that something uncommon is developing beneath the surface. It is worth noting that bear markets have been linked to negative 1-year percentage changes in the past when a small decline was followed by a robust bull market, with the exception of July 2020.

Currently, the ongoing setup is demonstrating a very similar trend to that of 2020, which makes this a rare event. However, for the flagship asset to flip this key metric to green again and become the second time in its history, it only has to increase by 4.5%.

In an alternate scenario where the metric fails to turn green or move upward, the annual performance will continue to be negative in line with prior bear market cycles. Meanwhile, whether Bitcoin breaks yet another uncommon historical pattern and initiates a new trend shift will depend on a move of about 5%.

Amid this impending rare shift, the buying pressure around Bitcoin is slowly picking up pace, as reported by Maartunn, a market expert and author at CryptoQuant. The BTC Taker Buy Sell Ratio metric is showing strong aggression on the buy side, particularly on the Bybit exchange, indicating a renewed conviction among investors.

Maartunn highlighted that the measure on Bybit has recently reached the 30.33 level, signaling overwhelming market buy pressure. Furthermore, this level of taker dominance indicates that large positions are steadily being created, with aggressive buyers taking control of the market.

BTC Experience A Key Breakout

Even in the volatile cryptocurrency market, several crucial metrics are beginning to flash strength and moving into positive territory again. One of the most recent metrics that has turned bullish is the Bitcoin Sharpe Ratio, a key gauge that measures returns against volatility.

In an X post, crypto expert CW noted that the metric has re-entered the yellow as seen on the chart, which suggests a breakout from a short-term bottom. The current trend indicates that the ongoing cycle has transitioned into a brief period of a high-risk zone.

During this period, there has been a consistent accumulation by large holders or whales, and indicators are demonstrating a breakout from the bottom. Such a bullish scenario hints at a possible rally in the near future, rekindling the bull market.

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Despite several drawbacks in Bitcoin price lately, the flagship asset appears to be gaining bullish momentum and holding above the $90,000 mark. Looking at the current market structure, BTC is hinting at one of its rarest setups that could reshape and determine the next potential direction.

Uncommon Bitcoin Market Structure In Sight

As seen in the cryptocurrency space, every market cycle has its own peculiarities, but Bitcoin is about to experience one of its most peculiar times yet. Alphractal, an advanced investment and data analytics platform, shared this development, which could reshape the current BTC trend.

Related Reading: Bitcoin Activity Decline Continues: Volume Downtrend Extends To 3 Years

Although no single indication can predict a result, the current configuration indicates that something uncommon is developing beneath the surface. It is worth noting that bear markets have been linked to negative 1-year percentage changes in the past when a small decline was followed by a robust bull market, with the exception of July 2020.

Currently, the ongoing setup is demonstrating a very similar trend to that of 2020, which makes this a rare event. However, for the flagship asset to flip this key metric to green again and become the second time in its history, it only has to increase by 4.5%.

In an alternate scenario where the metric fails to turn green or move upward, the annual performance will continue to be negative in line with prior bear market cycles. Meanwhile, whether Bitcoin breaks yet another uncommon historical pattern and initiates a new trend shift will depend on a move of about 5%.

Amid this impending rare shift, the buying pressure around Bitcoin is slowly picking up pace, as reported by Maartunn, a market expert and author at CryptoQuant. The BTC Taker Buy Sell Ratio metric is showing strong aggression on the buy side, particularly on the Bybit exchange, indicating a renewed conviction among investors.

Maartunn highlighted that the measure on Bybit has recently reached the 30.33 level, signaling overwhelming market buy pressure. Furthermore, this level of taker dominance indicates that large positions are steadily being created, with aggressive buyers taking control of the market.

BTC Experience A Key Breakout

Even in the volatile cryptocurrency market, several crucial metrics are beginning to flash strength and moving into positive territory again. One of the most recent metrics that has turned bullish is the Bitcoin Sharpe Ratio, a key gauge that measures returns against volatility.

Related Reading: Here’s Why Bitcoin’s Next Major Rally Matters For Short-Term BTC Holders’ Sentiment

In an X post, crypto expert CW noted that the metric has re-entered the yellow as seen on the chart, which suggests a breakout from a short-term bottom. The current trend indicates that the ongoing cycle has transitioned into a brief period of a high-risk zone.

During this period, there has been a consistent accumulation by large holders or whales, and indicators are demonstrating a breakout from the bottom. Such a bullish scenario hints at a possible rally in the near future, rekindling the bull market.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Dogecoin

Dogecoin  Wrapped SOL

Wrapped SOL