In a sudden pullback on Thursday, the price of Bitcoin has fallen below the $110,000 level again as the broader cryptocurrency market shifted toward a more bearish state. Even with the bearish performance in BTC’s price, many investors continue to hold on to their coins instead of selling them off.

No Major Shift In BTC Exchange Withdrawals

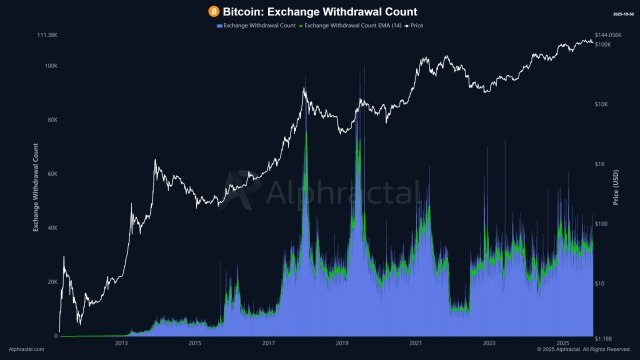

Bitcoin investors on crypto exchanges are still exhibiting positive behaviors amid waning market performance. Joao Wedson, the founder of Alphractal and author at CryptoQuant, stated that the number of Bitcoin withdrawals from crypto exchanges has remained almost unchanged, reflecting a period of calm and caution among market participants.

After delving into the Bitcoin Exchange Withdrawal Count metric, the market expert stated that investors have maintained this trend since October 2024. Investors are keeping their present exchange balances, neither hurrying to get self-custody nor flooding the market with new inflows, despite recent price swings and shifting attitudes.

Wedson highlighted that this stability is reflecting something crucial: The market is witnessing low on-chain engagement for Bitcoin for the first time in a cycle. Instead of transferring money straight into the blockchain, data indicates that a large number of investors are opting to store their BTC on exchanges or conduct transactions there.

Meanwhile, the expert has compared the Bitcoin On-Chain Volume with the On-Chain Volume of Stablecoin. After his comparison of the two key metrics, Wedson has revealed a striking difference.

Presently, the on-chain activity of Bitcoin is at its lowest point ever, which suggests that very few are making use of the blockchain. However, the volume of stablecoins is soaring, hitting new highs every day.

What this simply means is that Bitcoin’s blockchain is silent while stablecoins are bolstering liquidity across the market. “A contrast that says a lot about investor behavior in this phase of the cycle,” Wedson added. In the meantime, this stability in exchange withdrawal activity reflects a neutral stance, as traders watch for more precise clues regarding Bitcoin’s next significant move.

Whales Are On A BTC Buying Spree

Despite the fluctuating price performance, large BTC investors or whales are steadily active in the market. Ali Martinez, a seasoned market expert, has revealed that bullish action has been observed among these key investors.

According to Martinez, the Bitcoin network is seeing an increase in whale activity as transactions exceeding $1 million surge. Data shows that the total number of transactions of this size has reached 6,311, marking a two-month high.

With deep-pocketed investors’ transactions increasing during a decline in price, this movement might suggest that the investors are repositioning themselves for the next possible bullish wave. Furthermore, it may be a sign of increased optimism about BTC’s medium-term prospects or, on the other hand, of calculated profit-taking as the market becomes more volatile.

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

In a sudden pullback on Thursday, the price of Bitcoin has fallen below the $110,000 level again as the broader cryptocurrency market shifted toward a more bearish state. Even with the bearish performance in BTC’s price, many investors continue to hold on to their coins instead of selling them off.

No Major Shift In BTC Exchange Withdrawals

Bitcoin investors on crypto exchanges are still exhibiting positive behaviors amid waning market performance. Joao Wedson, the founder of Alphractal and author at CryptoQuant, stated that the number of Bitcoin withdrawals from crypto exchanges has remained almost unchanged, reflecting a period of calm and caution among market participants.

Related Reading: Bitcoin Dolphins Are Dominating With Rapid Buying, How Much Have They Bought And Hold?

After delving into the Bitcoin Exchange Withdrawal Count metric, the market expert stated that investors have maintained this trend since October 2024. Investors are keeping their present exchange balances, neither hurrying to get self-custody nor flooding the market with new inflows, despite recent price swings and shifting attitudes.

Wedson highlighted that this stability is reflecting something crucial: The market is witnessing low on-chain engagement for Bitcoin for the first time in a cycle. Instead of transferring money straight into the blockchain, data indicates that a large number of investors are opting to store their BTC on exchanges or conduct transactions there.

Meanwhile, the expert has compared the Bitcoin On-Chain Volume with the On-Chain Volume of Stablecoin. After his comparison of the two key metrics, Wedson has revealed a striking difference.

Presently, the on-chain activity of Bitcoin is at its lowest point ever, which suggests that very few are making use of the blockchain. However, the volume of stablecoins is soaring, hitting new highs every day.

What this simply means is that Bitcoin’s blockchain is silent while stablecoins are bolstering liquidity across the market. “A contrast that says a lot about investor behavior in this phase of the cycle,” Wedson added. In the meantime, this stability in exchange withdrawal activity reflects a neutral stance, as traders watch for more precise clues regarding Bitcoin’s next significant move.

Whales Are On A BTC Buying Spree

Despite the fluctuating price performance, large BTC investors or whales are steadily active in the market. Ali Martinez, a seasoned market expert, has revealed that bullish action has been observed among these key investors.

Related Reading: Bitcoin Mid-Size Whales Aggressively Expanding Their Stash – What This Means For The Market

According to Martinez, the Bitcoin network is seeing an increase in whale activity as transactions exceeding $1 million surge. Data shows that the total number of transactions of this size has reached 6,311, marking a two-month high.

With deep-pocketed investors’ transactions increasing during a decline in price, this movement might suggest that the investors are repositioning themselves for the next possible bullish wave. Furthermore, it may be a sign of increased optimism about BTC’s medium-term prospects or, on the other hand, of calculated profit-taking as the market becomes more volatile.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Dogecoin

Dogecoin  Solana

Solana