The US federal funding lapse has stretched on, creating new delays for regulatory decisions tied to crypto products. According to reports, the shutdown has lasted beyond 40 days in some scenarios used by market forecasters, and reduced staffing at federal agencies is slowing routine approvals.

Shutdown Stretches Past 40 Days

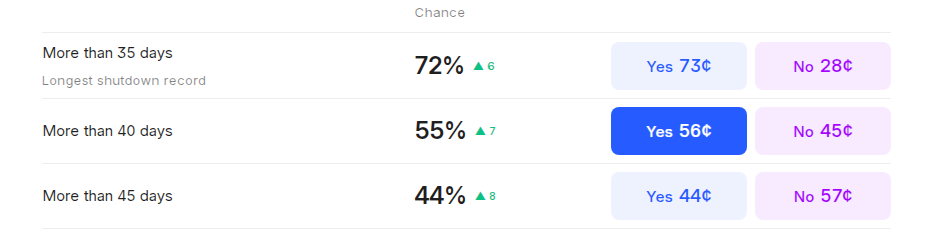

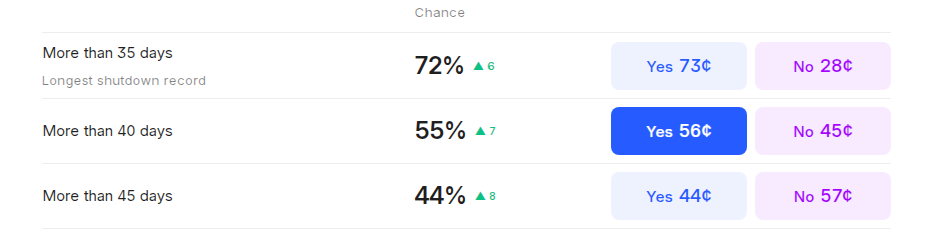

Reports have disclosed a market estimate putting the chance of a prolonged shutdown at about 55% for certain stretches, which traders say complicates timing for filings and reviews.

The Securities and Exchange Commission is operating with fewer staff, and that has forced some rulemakings and approval windows to be pushed back. For applicants hoping for quick sign-offs, this means waiting longer than planned.

Investor Interest Remains High

Despite the holdup, investor appetite for regulated crypto products appears strong. According to filings and traffic data cited in market reports, clients of Charles Schwab hold roughly 20% of the US crypto ETF market by assets under custody, and web visits to crypto information pages have jumped about 90% on an annualized basis. That shows demand is not evaporating while regulators are idle.

What That Means For Markets

When reviews resume in force, some strategists expect pent-up demand to move into newly approved products. Based on reports, the delay has simply shifted the calendar rather than killed the approvals.

Yet market reaction is not guaranteed to be large; some money may already be waiting on the sidelines, while other investors have moved on.

Backlog Could Trigger A Fast Response

Regulatory staff will face a backlog when full operations return. Papers awaiting attention may be prioritized, and several issuers will press to get decisions cleared.

Sources tracking the space warn that a sudden cluster of approvals could follow the end of the funding gap, creating rapid inflows into the newly cleared funds.

Risks Beyond Timing

The shutdown is one of several risks. Reports point to the fact that approvals depend on legal arguments, compliance steps, and the agency’s view on market structure.

A temporary staffing shortfall delays work, but it does not change the substantive questions the regulator must answer before signing off. That means some applications could still be rejected or heavily conditioned.

Featured image from Unsplash, chart from TradingView

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The US federal funding lapse has stretched on, creating new delays for regulatory decisions tied to crypto products. According to reports, the shutdown has lasted beyond 40 days in some scenarios used by market forecasters, and reduced staffing at federal agencies is slowing routine approvals.

Related Reading: Crypto In Ghana: Lawmakers Race To Write Rules Before December

Shutdown Stretches Past 40 Days

Reports have disclosed a market estimate putting the chance of a prolonged shutdown at about 55% for certain stretches, which traders say complicates timing for filings and reviews.

The Securities and Exchange Commission is operating with fewer staff, and that has forced some rulemakings and approval windows to be pushed back. For applicants hoping for quick sign-offs, this means waiting longer than planned.

Source: Kalshi

Investor Interest Remains High

Despite the holdup, investor appetite for regulated crypto products appears strong. According to filings and traffic data cited in market reports, clients of Charles Schwab hold roughly 20% of the US crypto ETF market by assets under custody, and web visits to crypto information pages have jumped about 90% on an annualized basis. That shows demand is not evaporating while regulators are idle.

What That Means For Markets

When reviews resume in force, some strategists expect pent-up demand to move into newly approved products. Based on reports, the delay has simply shifted the calendar rather than killed the approvals.

Yet market reaction is not guaranteed to be large; some money may already be waiting on the sidelines, while other investors have moved on.

Backlog Could Trigger A Fast Response

Regulatory staff will face a backlog when full operations return. Papers awaiting attention may be prioritized, and several issuers will press to get decisions cleared.

Sources tracking the space warn that a sudden cluster of approvals could follow the end of the funding gap, creating rapid inflows into the newly cleared funds.

Related Reading: Crypto On The Menu: US Fastfood Chain Rolls Out Bitcoin Steakburger

Risks Beyond Timing

The shutdown is one of several risks. Reports point to the fact that approvals depend on legal arguments, compliance steps, and the agency’s view on market structure.

A temporary staffing shortfall delays work, but it does not change the substantive questions the regulator must answer before signing off. That means some applications could still be rejected or heavily conditioned.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin