XRP’s valuation ballooned by roughly $16.6 billion in the space of just thirteen hours overnight, yet blockchain-data researcher Dom (@traderview2) says the net spot inflows that set the move in motion add up to only $61 million.

“Ever wondered how much money it takes to cause a 16.6 B increase in XRP market cap? … 61 M USD. That’s the net market buying pressure we saw over the last 13 hours,” Dom wrote on X, adding, “So yes, 61 M USD of buy pressure caused a 16.6 B increase in market cap. There’s your daily lesson that market cap is irrelevant – all that matters is liquidity.”

Dom’s figures imply that each fresh on-exchange dollar was levered more than 270-fold into notional capitalization, a point underscored when fellow chartist EGRAG CRYPTO (@egragcrypto) replied that the relationship between net flows and apparent value expansion can range “15 × to 30 ×” in ordinary conditions

The overnight episode demonstrates why market capitalization – circulation multiplied by last price – is a context-free snapshot rather than a cash-backed balance-sheet number: only the marginal trade sets the price that instantaneously re-marks every unit of supply.

How can $61 Million In XRP Cause This?

Order-book micro-structure offers the first clue. Most liquidity on centralised venues such as Binance, Upbit and Coinbase sits well outside the top-of-book; the visible spread can be millimetres thick compared with the billions in supposed float.

When incremental bids walk the ask ladder, automated market-makers and human market-makers both adjust offers higher, and each uptick immediately revalues every coin in existence. The result is a geometric expansion (or contraction) of market cap that vastly exceeds the underlying cash flow until arbitrage or profit-taking restores depth.

The XRP case also highlights the crucial difference between realised cap – what holders actually paid – and headline cap. Ripple’s quarterly reports show that roughly half the supply has not yet circulated, meaning the effective free float is even smaller than the raw 59 billion figure. When dormant coins do not actively meet bids, small flows punch above their weight. Analysts caution that the same mechanical effect can work in reverse, exaggerating sell-offs when liquidity thins.

For traders, Dom concludes, the episode is “a reminder to focus on volume-weighted liquidity metrics rather than vanity cap tables.” Whether one views the 16-hour spike as a bullish signal or a statistical curiosity, it offers a timely lesson in how crypto markets still trade more like frontier equities than mature commodities: price is set at the margin, and the margin can be razor-thin.

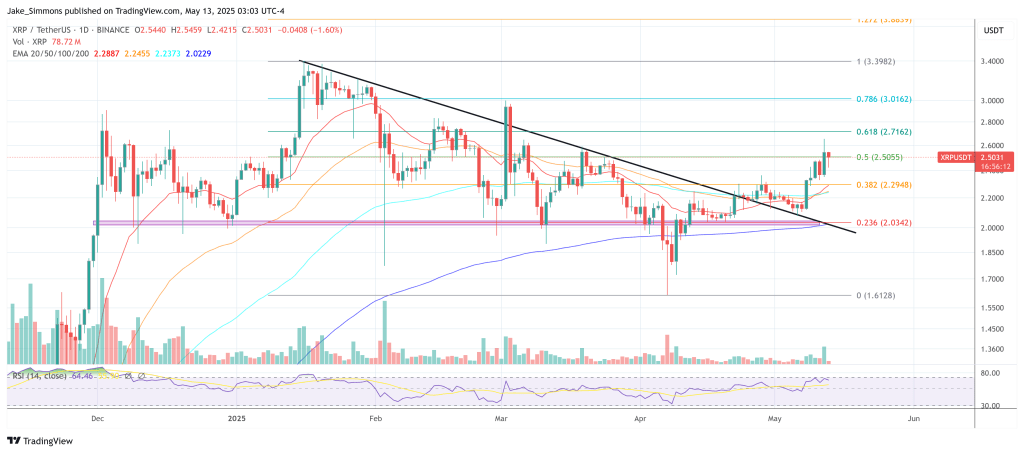

At press time, XRP changed hands at $2.50 with 24-hour turnover just above $11 billion, giving the token a market cap of $146.2 billion and cementing its No. 4 slot.

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

XRP’s valuation ballooned by roughly $16.6 billion in the space of just thirteen hours overnight, yet blockchain-data researcher Dom (@traderview2) says the net spot inflows that set the move in motion add up to only $61 million.

“Ever wondered how much money it takes to cause a 16.6 B increase in XRP market cap? … 61 M USD. That’s the net market buying pressure we saw over the last 13 hours,” Dom wrote on X, adding, “So yes, 61 M USD of buy pressure caused a 16.6 B increase in market cap. There’s your daily lesson that market cap is irrelevant – all that matters is liquidity.”

Dom’s figures imply that each fresh on-exchange dollar was levered more than 270-fold into notional capitalization, a point underscored when fellow chartist EGRAG CRYPTO (@egragcrypto) replied that the relationship between net flows and apparent value expansion can range “15 × to 30 ×” in ordinary conditions

The overnight episode demonstrates why market capitalization – circulation multiplied by last price – is a context-free snapshot rather than a cash-backed balance-sheet number: only the marginal trade sets the price that instantaneously re-marks every unit of supply.

Related Reading: XRP Analyst Highlights Ultimate Targets And Selling Strategy As XRP Price Rebounds

Order-book micro-structure offers the first clue. Most liquidity on centralised venues such as Binance, Upbit and Coinbase sits well outside the top-of-book; the visible spread can be millimetres thick compared with the billions in supposed float.

When incremental bids walk the ask ladder, automated market-makers and human market-makers both adjust offers higher, and each uptick immediately revalues every coin in existence. The result is a geometric expansion (or contraction) of market cap that vastly exceeds the underlying cash flow until arbitrage or profit-taking restores depth.

Related Reading: SBI Teases Explosive Ripple Valuation Ahead Of Potential IPO

The XRP case also highlights the crucial difference between realised cap – what holders actually paid – and headline cap. Ripple’s quarterly reports show that roughly half the supply has not yet circulated, meaning the effective free float is even smaller than the raw 59 billion figure. When dormant coins do not actively meet bids, small flows punch above their weight. Analysts caution that the same mechanical effect can work in reverse, exaggerating sell-offs when liquidity thins.

For traders, Dom concludes, the episode is “a reminder to focus on volume-weighted liquidity metrics rather than vanity cap tables.” Whether one views the 16-hour spike as a bullish signal or a statistical curiosity, it offers a timely lesson in how crypto markets still trade more like frontier equities than mature commodities: price is set at the margin, and the margin can be razor-thin.

At press time, XRP changed hands at $2.50 with 24-hour turnover just above $11 billion, giving the token a market cap of $146.2 billion and cementing its No. 4 slot.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Dogecoin

Dogecoin  Wrapped SOL

Wrapped SOL